Sweeping 2025 tariff changes are forcing profound transformation across the food and beverage industry. The new structure imposes a universal 10% tariff on imports, with additional country-specific rates reaching 125% for Chinese goods, 20% for EU products, and 46% for Vietnamese imports. According to the Yale Budget Lab, effective U.S. tariff rates have surged to 22.5%, levels unseen since 1909, increasing consumer prices by 2.3% and costing households up to $3,800 annually.

Understanding U.S. Tariffs' Impact on the Food & Beverage Industry

Tariffs are taxes on imported goods that protect domestic industries, raise government revenue, address trade imbalances, and provide leverage in negotiations. For food and beverage companies, these import taxes significantly increase costs for ingredients, packaging, and finished products.

The 2025 U.S. tariff structure creates complex challenges with its layered approach:

- Universal 10% tariff on all imported goods

- Country-specific tariffs are applied on top of the universal rate

- Varying rates by product category and origin

Key examples of total tariff rates:

- Chinese goods: 34% (10% universal + 24% country-specific)

- EU products: 20% (10% universal + 10% EU-specific)

- Vietnamese imports: 46% (10% universal + 36% country-specific)

The impact varies across product categories:

- U.S. bakeries face 7–12% higher input costs on imported flour, sugar, and oils (PastryStar)

- Beverage packaging costs rose 15–20% due to aluminum tariffs

- Fresh vegetables, liquor, and specialty crops experience significant price increases (Fortune Business Insights)

These policies protect domestic industries but create widespread ripple effects throughout the global supply chain.

Direct Impact on the Food & Beverage Supply Chain

The 2025 tariff structure has dramatically altered import-export relationships across the industry. Most food and beverage imports face the universal 10% tariff plus country-specific rates, forcing companies to reconsider international sourcing strategies.

Cost Implications by Category

- Fresh Produce: Vegetables and fruits from Mexico and the EU face substantial price increases

- Alcoholic Beverages: EU wines and spirits cost 20% more due to tariffs

- Bakery Ingredients: Input costs have risen 7–12% (PastryStar)

- Seafood: Chinese, Vietnamese, and Thai imports face tariffs exceeding 30%

- Beverages: Aluminum tariffs have increased packaging costs by 15–20%

Supply Chain Adaptations

Companies are implementing creative solutions to address these challenges:

- Diversifying Suppliers: Seeking partners in low-tariff countries or exploring domestic options

- Reformulating Products: Modifying recipes to reduce dependence on heavily-tariffed ingredients

- Vertical Integration: Investing in domestic production to reduce import reliance

- Strategic Pricing: Carefully adjusting prices based on competition and consumer sensitivity

- Advanced Inventory Management: Optimizing stock levels to minimize tariff impacts

These adjustments reflect what industry analysts call a "total landscape supply" approach—treating tariffs as a permanent consideration in supply chain strategy rather than a temporary disruption.

Strategic Implications for Industry Stakeholders

Each segment of the food and beverage industry faces unique challenges requiring targeted responses to the new tariff landscape.

Risk Management Approaches

Importers stand at the front lines, directly absorbing tariff costs. Many have renegotiated contracts, diversified suppliers, or accepted reduced margins. A French cheese importer facing 20% tariffs has scaled back orders and sought alternative suppliers, often sacrificing product quality (Fortune Business Insights).

Distributors experience pressure from rising wholesale prices while retailers resist passing increases to consumers. This "margin crunch" has pushed many to diversify supply networks despite transition costs and logistical challenges.

Operational Adjustments

Companies throughout the supply chain are implementing significant operational changes:

- Supplier Diversification: Actively seeking alternatives to heavily tariffed ingredients from domestic suppliers or countries with favorable trade terms

- Product Reformulation: Reworking recipes and creating new product lines built around locally sourced components

- Vertical Integration: Investing in domestic agricultural operations for greater cost control and supply stability

- Technology Investment: Implementing advanced inventory systems and AI-powered analytics to optimize stock and predict price changes (CBIZ)

- Strategic Pricing: Developing sophisticated approaches including targeted increases, "shrinkflation," and premium product tiers

These adjustments impact specific sectors differently:

New Jersey grocers report 20-30% price increases for imported specialty wines since early Q2 2025, affecting both sales volume and customer loyalty (Rutgers DAFRE).

Consumers ultimately bear these costs, with the Yale Budget Lab estimating that households spend hundreds more on food annually due to tariffs, driving shifts toward store brands, fewer imported products, and domestic alternatives.

Consumer Behavior and Market Trends

Tariff-driven food inflation, expected to reach mid-single-digit increases throughout 2025, has significantly altered consumer shopping habits.

Shifts in Consumer Purchasing

Price-conscious consumers are adapting by:

- Choosing store brands over national brands

- Reducing purchases of specialty or imported products

- Switching to domestic alternatives when available

- Prioritizing value over brand loyalty

These shifts create opportunities for U.S. producers while challenging importers of specialty items. The 20-30% retail price increases for imported specialty products have driven consumers toward domestic alternatives.

Market Adaptation Examples

New Jersey's wine industry exemplifies successful adaptation. With 20% tariffs on EU wines, consumers have shifted to local options, prompting New Jersey wineries to invest in marketing that highlights quality and value.

Similarly, U.S. cheesemakers are filling the gap left by expensive European imports, creating innovative domestic varieties that appeal to price-conscious consumers seeking alternatives to tariff-affected imports.

These market shifts may become permanent if tariffs remain in place, as consumers discover new domestic favorites and adjust their preferences accordingly.

Retailers are responding by allocating more shelf space to domestic products and store brands, while distributors rethink sourcing strategies to balance consumer demand with cost considerations.

Technological and Business Innovations in Response

Companies are leveraging technology and innovative business models to navigate tariff challenges more effectively.

Technology Solutions

Advanced analytics and AI are transforming supply chain management:

Stay ahead with the latest industry insights and trends.

- Predictive analytics forecasts tariff-related disruptions

- AI-powered demand planning optimizes inventory levels

- Blockchain technology increases supply chain transparency

- Digital procurement platforms identify alternative suppliers

- Smart manufacturing systems adjust production based on ingredient costs

- Tariff modeling software prepares companies for various scenarios

One beverage manufacturer implemented an AI supply chain system that reduced tariff-related cost increases by 35% through optimized sourcing and production.

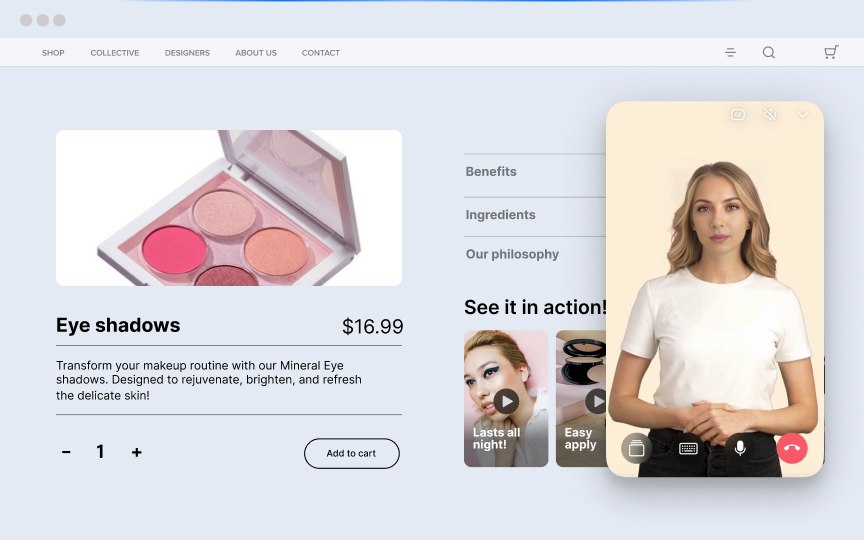

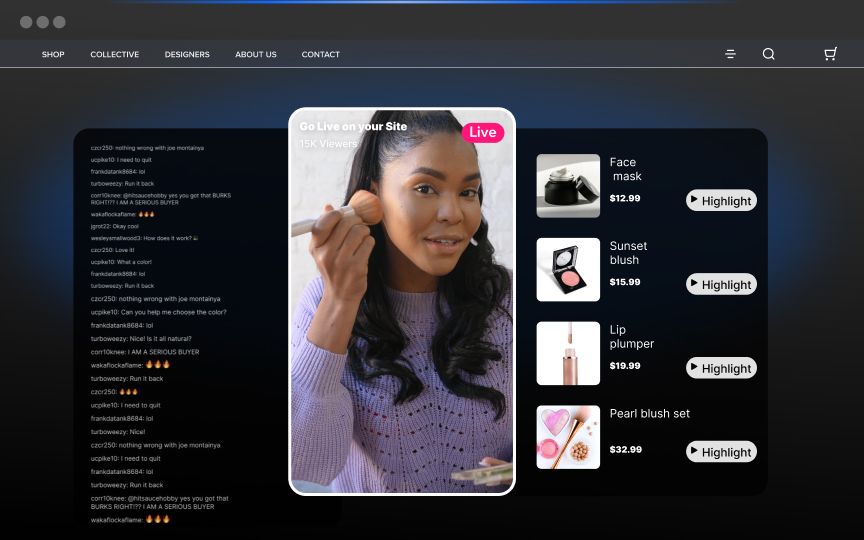

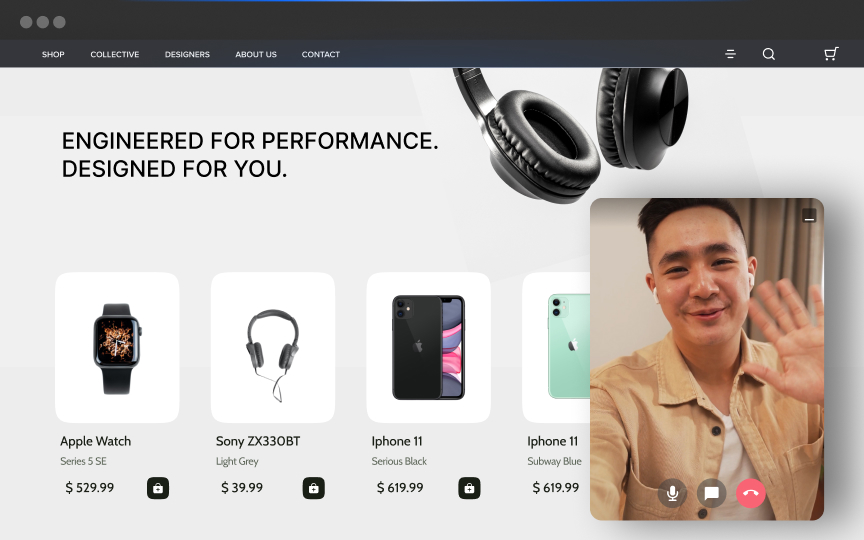

Companies seeking innovative ways to showcase products amid these challenges are exploring shoppable video solutions that enhance customer engagement while highlighting domestic alternatives to tariff-affected imports.

Innovative Business Models

Companies are adopting creative approaches to maintain competitiveness:

- Localization strategies reduce reliance on imported ingredients

- Vertical integration invests in domestic farming and production

- Product reformulation uses fewer tariff-affected ingredients

- AI-driven dynamic pricing responds to changing tariff landscapes

- Subscription models smooth price fluctuations for consumers

- Industry consortiums form collective purchasing groups

- Virtual shopping experiences connect consumers with products in new ways

A national bakery chain developed a local sourcing strategy that reduced tariff exposure by 60% while creating a compelling brand story around supporting local agriculture.

Businesses looking to maintain customer relationships despite price pressures are implementing one-to-one virtual shopping to provide personalized advice on alternative products when tariffs affect the availability or pricing of imported items.

Unlock Exclusive Insights

By submitting this form, you agree to Firework's privacy policy and consent to receive personalized marketing communications. You can unsubscribe at any time.